Financial Aid Explained

Understand the Financial Aid Process

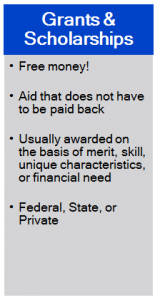

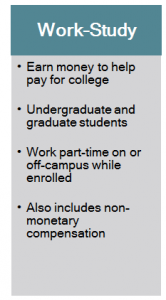

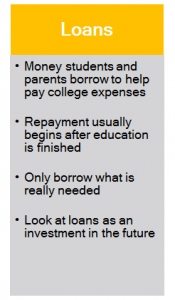

Believe it or not, everyone qualifies for some type of financial aid. But do you know what colleges mean when they say “Financial Aid”? Most people think financial aid is only free money. That’s not the case. Financial Aid consists of several components: grants, scholarships, loans, and work study. Some of this aid does not have to be repaid, some do.

We’ve heard many people say that after filing the FAFSA and/or the CSS Profile they “did not receive any financial aid” because they were only offered Direct Loans. These low interest loans are considered financial aid because they can only be awarded to students to file the Free Application for Student Financial Aid (FAFSA).

In general, financial aid is divided into need-based and non-need based assistance. Need based is what most people consider “financial aid” – grants, scholarships, work study, and subsidized loans. Non-need based assistance consists of unsubsidized loans and PLUS loans.

A good plan is to understand what type of financial aid assistance you may be awarded based on the information you put on your FAFSA and/or CSS Profile and what, if any, steps can be taken to increase your eligibility for need-based aid.

That’s why F.A.C.S. is the best choice for you!

What Exactly does “need-based” financial aid mean?

Your “need” for financial aid purposes is determined by taking the school’s reported Cost of Attendance (COA) and subtracting your Expected Family Contribution (EFC). The amount remaining is considered your “need”. For schools using the FAFSA, the EFC is calculated by the federal government and stays consistent no matter which institution you choose. This is called Federal Methodology (FM). Schools that require the FAFSA only will use this EFC to determine your need.

For schools that also use the CSS Profile, the EFC calculated will vary by institution, as each school views your data differently and customizes their calculation to fit their needs. This is called Institutional Methodolgy (IM). This method takes other things into consideration that the FAFSA does not, such as home equity, market value of your business (if you own one), and other untaxed income and allowable deductions. Retirement value is reported but it is not used to determine the EFC.

A small number of institutions use a third method called the Consensus Method. It is very similar to IM with some slight variations. Home equity is viewed differently and may be capped at a certain percentage based on the family’s income. (Note: some IM schools use this treatment as well). Student assets are treated similarly to parent assets which is not the case for FM or IM.

We can help you understand which methodology is used by your targeted colleges. We can also find schools that will give you a more favorable treatment with award offers.

Types of FInancial Aid

Not all Financial Aid is FREE

We’ve heard many people say that after filing the FAFSA and/or the CSS Profile they “did not receive any financial aid” because they were only offered Direct Loans. These low-interest loans are considered financial aid because they can only be awarded to students to file the Free Application for Student Financial Aid (FAFSA).

In general, financial aid is divided into need-based and non-need based assistance. Need-based is what most people consider “financial aid” – grants, scholarships, work-study, and subsidized loans. Non-need based assistance consists of unsubsidized loans and PLUS loans.

A good plan is to understand what type of financial aid assistance you may be awarded based on the information you put on your FAFSA and/or CSS Profile and what, if any, steps can be taken to increase your eligibility for need-based aid. That’s where FACS can help!

Federal Aid

The U.S. Department of Education awards over $120 billion each year in grants, work-study, and loans to more than 13 million students. Federal financial aid is used to cover most of the expenses associated with college: tuition and fees, room and board, books and supplies, and transportation and personal expenses. This aid can also be used to assist with additional expenses such as child care and purchasing a computer or laptop.

Grants – Financial aid that does not need to be repaid*

Loans – Loans borrowed from the Federal government for higher education (these must be repaid with interest)

Work-Study – A Federal work program that helps you earn money to pay for school through part-time employment while you are enrolled.

*unless you withdraw and a portion of your aid must be returned

Institutional Aid

Some schools require the CSS Profile to be completed in addition to the FAFSA to determine eligibility for their institutional funds. The CSS Profile enables colleges and universities to see a true picture of a family’s financial need beyond what is reported on the FAFSA. This allows them to determine the best way to award their own need-based grant funds to students.